The article will give a detail information about 5 Best Travel Insurances for Indians while traveling outside India and going to outbound travel destination like South East Asia, Europe and other countries.

Below is the list of 5 Best Travel Insurances for Indians:

- Tata AIG

TataAIG Travel Insurance is a popular product offered by Tata AIG General Insurance Company, one of the leading insurance providers in India. The travel insurance plans provided by Tata AIG are designed to offer coverage and protection against a wide range of unforeseen events and risks that travellers might encounter while traveling domestically or internationally. .(UAE, Thailand, Bali, Indonesia)

Key Features of Tata AIG Travel Insurance:

- Medical Expenses Coverage: This covers medical emergencies, hospitalization, and other related expenses incurred during the trip.

- Trip Cancellation/Interruption: Reimbursement for the non-refundable expenses in case the trip is cancelled or interrupted due to covered reasons like illness, injury, or other emergencies.

- Loss of Baggage: Compensation for loss or delay of checked-in baggage.

- Personal Accident: Coverage for accidental death or permanent disability during the trip.

- Travel Assistance: 24×7 emergency assistance services, including help with lost passports, medical evacuations, or other emergencies.

- Coverage for Pre-Existing Conditions: Some plans offer limited coverage for pre-existing medical conditions, though this often comes with specific terms and conditions.

- Cashless Hospitalization: Access to cashless hospitalization facilities across a network of hospitals globally.

Types of Plans Available:

- Individual Travel Insurance: Suitable for solo travellers.

- Family Travel Insurance: Covers the entire family, often including dependent children and spouse.

- Senior Citizen Travel Insurance: Tailored plans for travelers above a certain age, typically over 60 or 65 years.

- Student Travel Insurance: Specifically designed for students traveling abroad for studies.

- Multi-Trip Insurance: Ideal for frequent travellers, providing coverage for multiple trips within a specified period, usually a year.

How to Buy Tata AIG Travel Insurance:

- Online: You can purchase the policy directly from Tata AIG’s official website or through various insurance aggregators.

- Agents and Brokers: You can also buy through authorized agents and brokers.

- Banks and Partners: Many banks and financial institutions offer Tata AIG Travel Insurance as part of their product offerings.

Claim Process:

The claim process typically involves notifying the insurer, submitting necessary documents (such as medical reports, police reports in case of theft, etc.), and following the procedure as outlined in the policy document. Tata AIG is known for its relatively straightforward and customer-friendly claim process.

If you have specific questions about coverage, exclusions, or premium costs, you can get a quote or detailed information directly from Tata AIG’s website or through their customer service.

Travel insurance benefits include cashless hospitalisation, baggage & flight delay, passport loss, trip cancellation and more. These benefits are valid for your entire trip until your return to India. You may be visiting one country or multiple, be a student or a senior citizen. No matter who you are, you will always find the best travel insurance from India for all kinds of journeys.

#TravelInsurance #Template #InsuranceSales #travelagent #travelinsurance #tripprotection #travelagency #travelagenttemplate #travelcanva #canvatravel #traveladvisor

2. CARE HEALTH INSURANCE

Care Health Insurance offers travel insurance plans that are designed to provide comprehensive coverage for various types of travellers, including individuals, families, and students. The key features of Care Health Insurance’s travel insurance plans typically include:

a. Medical Coverage:

- Emergency Medical Expenses: Covers costs related to hospitalization, treatment, and other medical emergencies during the trip.

- Medical Evacuation: Covers expenses for emergency medical evacuation to the nearest medical facility or back to India if necessary.

- Repatriation of Mortal Remains: Covers the cost of transporting the insured’s remains back to their home country in the event of death during the trip.

b. Trip-Related Coverage:

- Trip Cancellation/Interruption: Reimburses non-refundable expenses if the trip is cancelled or interrupted due to covered reasons like illness, injury, or natural disasters.

- Loss of Passport: Covers the costs associated with obtaining a new or duplicate passport if it is lost during the trip.

- Trip Delay: Provides compensation for additional expenses incurred due to delays in flight departures.

c. Baggage Coverage:

- Loss of Baggage: Provides compensation for checked-in baggage that is lost or stolen during the trip.

- Delay of Checked Baggage: Reimburses the cost of essential items purchased due to delayed baggage.

d. Personal Liability:

- Covers legal expenses and compensation if the insured is found legally liable for causing injury or damage to a third party during the trip.

e. Hijack Distress Allowance:

- Offers a daily allowance in the event that the insured’s flight is hijacked.

f. Additional Benefits:

- Financial Emergency Assistance: Provides financial assistance in case of emergencies like theft or loss of funds during the trip.

- Personal Accident: Offers coverage for accidental death or disability during the trip.

- Adventure Sports Coverage: Some plans may include coverage for injuries sustained while participating in certain adventure sports.

Types of Plans:

- Single-Trip Insurance: Ideal for short trips, covering you from the start to the end of your journey.

- Multi-Trip Insurance: Suitable for frequent travellers, offering coverage for multiple trips within a year.

- Student Travel Insurance: Specifically designed for students studying abroad, providing coverage for medical emergencies, study interruptions, and other needs.

- Senior Citizen Travel Insurance: Tailored for older travellers, typically offering extended medical coverage and other benefits suited to their needs.

Care Health Insurance’s travel insurance plans are customizable, allowing travellers to select the specific coverage options they need based on their destination, trip duration, and other factors. The premium amounts vary depending on the coverage chosen and the specifics of the trip.

Travel insurance is important because it provides comprehensive protection against a wide range of potential problems that could arise during your trip. It helps mitigate financial losses and ensures that you have access to necessary resources in emergencies, making it a valuable investment for any traveller. #travel #travelinsurance #travelhack

3. ICICI Lombard

ICICI Lombard offers a range of travel insurance plans tailored for different types of travellers, including individuals, families, students, and senior citizens. Their travel insurance plans typically include the following features:

1. Medical Coverage:

- Emergency Medical Expenses: Covers hospitalization, treatment, and other medical expenses incurred during the trip due to illness or accidents.

- Medical Evacuation: Covers the cost of emergency evacuation to the nearest medical facility or back to India if necessary.

- Repatriation of Mortal Remains: Covers the cost of returning the insured’s remains to their home country in case of death.

2. Trip-Related Coverage:

- Trip Cancellation/Interruption: Reimburses non-refundable expenses if the trip is cancelled or interrupted due to covered reasons, such as illness, injury, or natural disasters.

- Loss of Passport: Covers the expenses involved in obtaining a duplicate or new passport if it is lost during the trip.

- Trip Delay: Provides compensation for additional expenses incurred due to flight delays beyond a certain number of hours.

3. Baggage Coverage:

- Loss of Baggage: Provides compensation for lost or stolen checked baggage.

- Delay of Checked Baggage: Reimburses expenses for essential items purchased due to delayed baggage.

4. Personal Liability:

- Covers legal expenses and compensation if the insured is found legally liable for causing injury or property damage to a third party during the trip.

5. Hijack Distress Allowance:

- Provides a fixed daily allowance if the insured’s flight is hijacked.

6. Additional Benefits:

- Financial Emergency Assistance: Provides cash assistance in case of financial emergencies like theft or loss of funds during the trip.

- Adventure Sports Cover: Some plans offer coverage for injuries sustained while participating in certain adventure sports.

Types of Plans:

- Single-Trip Insurance: Covers a one-time trip and is ideal for short vacations or business trips.

- Multi-Trip Insurance: Offers coverage for multiple trips within a year, suitable for frequent travellers.

- Student Travel Insurance: Tailored for students studying abroad, covering medical expenses, study interruptions, and other specific needs.

- Senior Citizen Travel Insurance: Specially designed for older travelers, typically offering extended medical coverage.

ICICI Lombard’s travel insurance plans are customizable, allowing travelers to select the coverage and benefits that best suit their needs. Premiums vary based on factors like the destination, trip duration, and chosen coverage options.

ICICI Lombard is one of the leading providers of travel insurance in India. Their travel insurance policies are designed to cover a wide range of risks associated with both domestic and international travel. making it convenient to compare plans, get quotes, and purchase the policy. It’s important to read the policy documents carefully to understand the coverage, exclusions, and claim process. #TravelInsurance #Template #InsuranceSales #travelagent #travelinsurance #tripprotection #travelagency #travelagenttemplate #travelcanva #canvatravel #traveladvisor

4. Go Digit General Insurance

Go Digit General Insurance, commonly known as Digit Insurance, offers travel insurance plans designed to provide coverage for various risks and emergencies that travellers might face during their trips. Go Digit is known for its straightforward, digital-first approach, making it easy for customers to purchase, manage, and claim insurance policies online. (UAE, Thailand, Bali, Indonesia)

Key Features of Go Digit Travel Insurance:

- Medical Coverage: This includes coverage for medical emergencies, hospitalization, and even emergency medical evacuation if required.

- Trip Cancellation/Delay: Reimbursement for non-refundable expenses in case of trip cancellation or compensation for delays due to covered reasons like illness, injury, or unforeseen events.

- Loss of Baggage: Compensation for loss or delay of checked-in baggage, including coverage for essential items in case of baggage delay.

- Personal Accident Cover: Coverage for accidental death or permanent disability occurring during the trip.

- Adventure Sports Cover: Coverage for accidents or injuries while participating in adventure sports (specific plans only).

- Trip Interruption: Coverage for costs related to interrupting the trip due to covered reasons like a medical emergency.

- Coverage for Pre-Existing Conditions: Limited coverage for pre-existing medical conditions in some plans, subject to terms and conditions.

- Home Burglary Insurance: While you are traveling, some plans offer coverage against burglary or damage to your home.

- Customizable Coverage: Digit Insurance allows you to customize your travel insurance plan according to your needs, such as adding or removing specific covers.

Types of Travel Insurance Plans Offered by Go Digit:

- Individual Travel Insurance: Covers solo travellers.

- Family Travel Insurance: Provides coverage for families traveling together.

- Student Travel Insurance: Tailored for students traveling abroad for studies.

- Senior Citizen Travel Insurance: Specially designed plans for senior citizens, typically aged 60 or above.

- Frequent Traveler Insurance: Annual multi-trip plans for frequent travellers.

How to Buy Go Digit Travel Insurance:

- Online: You can purchase Digit travel insurance directly through their official website or mobile app. The process is digital, and you can get a quote, customize your plan, and make the payment online.

- Insurance Aggregators: Digit Insurance policies are also available through various insurance comparison websites.

- Customer Support: You can also buy or inquire about policies through their customer support.

Claim Process:

Digit Insurance is known for its simple and quick claim process. Claims can be initiated online or through their mobile app. You need to provide the necessary documentation (such as medical reports, bills, proof of loss, etc.), and the claims team assists you throughout the process. The company prides itself on its transparent and fast claims settlement process, often completing it digitally without much paperwork.

If you’re considering purchasing travel insurance from Go Digit, it’s a good idea to review their policy details and terms to ensure that it meets your specific needs, especially regarding coverage limits and exclusions.

Go Digit offers a hassle-free and largely digital claim process, making it convenient for travellers to file and track their claims online. They are known for quick settlements and responsive customer service. Go Digit Travel Insurance is easily accessible online, where you can compare different plans, get instant quotes, and purchase a policy in just a few steps. #TravelInsurance #Template #InsuranceSales #travelagent #travelinsurance #tripprotection #travelagency #travelagenttemplate #travelcanva #canvatravel #traveladvisor

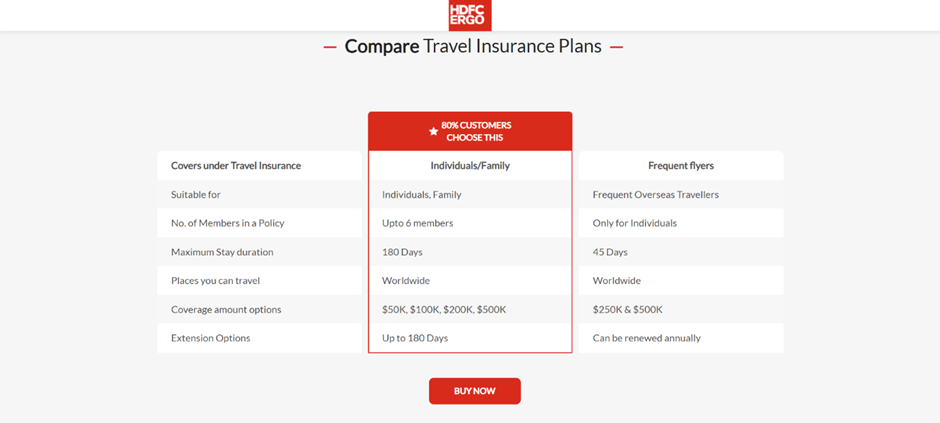

5. HDFC ERGO

HDFC ERGO offers a range of travel insurance plans designed to cover various travel-related risks. These plans are tailored to cater to different types of travellers, whether you are traveling domestically or internationally, for leisure or business.(UAE, Thailand, Bali, Indonesia)

Key Features of HDFC ERGO Travel Insurance:

- Medical Coverage: Covers expenses related to medical emergencies, including hospitalization, medical evacuation, and even dental treatments.

- Trip Cancellation & Curtailment: Provides reimbursement for non-refundable expenses if your trip is cancelled or cut short due to covered reasons.

- Baggage Loss/Delay: Compensates for loss or delay of checked-in baggage.

- Personal Liability: Covers legal expenses if you are held liable for third-party bodily injury or property damage during your trip.

- Emergency Cash Advance: Offers emergency financial assistance in case of theft or loss of money during travel.

- Loss of Passport: Covers the cost of obtaining a duplicate passport if yours is lost.

- Adventure Sports Cover: Some plans include coverage for accidents while participating in adventure sports.

Types of Travel Insurance Plans:

- Single Trip Insurance: For one-time travel, covering the duration of a specific trip.

- Multi-Trip Insurance: Designed for frequent travellers, offering coverage for multiple trips within a year.

- Student Travel Insurance: Tailored for students studying abroad, covering their health, travel, and study interruptions.

- Senior Citizen Travel Insurance: Specially designed for older travellers, usually offering extended medical coverage.

- Family Travel Insurance: Provides coverage for the entire family traveling together.

How to Purchase:

- Online: You can buy HDFC ERGO travel insurance online through their website or authorized agents.

- Offline: Available through HDFC ERGO branches and affiliated agents.

Claims Process:

- Online Claims: Claims can be filed online, with document submission and tracking available through their portal.

- 24/7 Assistance: They offer round-the-clock customer support for assistance during emergencies abroad.

It’s advisable to carefully review the policy details, including the terms and conditions, to ensure that the coverage meets your specific travel needs.

HDFC ERGO offers various travel insurance plans designed to cover different types of travellers, including individuals, families, and students. Their travel insurance typically provides coverage for:

- Medical Expenses: Covers emergency medical expenses incurred during the trip, including hospitalization and treatment costs.

- Trip Cancellation/Interruption: Reimbursement for non-refundable expenses if the trip is cancelled or interrupted due to specific covered reasons like illness or natural disasters.

- Baggage Loss/Delay: Compensation for lost, stolen, or delayed baggage during the trip.

- Loss of Passport: Covers the cost of obtaining a duplicate or new passport if it’s lost during the trip.

- Personal Liability: Provides coverage if the insured is held legally liable for causing damage to a third party.

- Flight Delay: Compensation for expenses incurred due to flight delays beyond a certain number of hours.

- Hijack Distress Allowance: A daily allowance provided if the insured’s flight is hijacked.

HDFC ERGO offers several plan options, such as single-trip, multi-trip, student travel, and senior citizen travel insurance. The coverage details, exclusions, and premium amounts can vary depending on the plan chosen. HDFC ERGO is known for its efficient and user-friendly claim process, with the ability to file and track claims online. They also offer a 24/7 customer support helpline to assist with any queries or claims-related